Tax ID Tangle Your Guide to Finding Your Business Tax ID Number (EIN)

Find Your Business Tax ID Number (EIN) with the Tax ID Tangle: The Complete Guide

Cracking the Code of Tax ID Mystery

Getting your company a distinctive identity is crucial in the complicated world of business operations. Often referred to as the business Tax ID, your Employer Identification Number (EIN) is the cornerstone of all financial transactions, legal compliance, and tax duties. This extensive book offers simple instructions to empower your business path and serves as your lighthouse in the maze of Tax ID complexities.

Why Is an EIN Important and What Does It Mean?

Knowing the Fundamentals

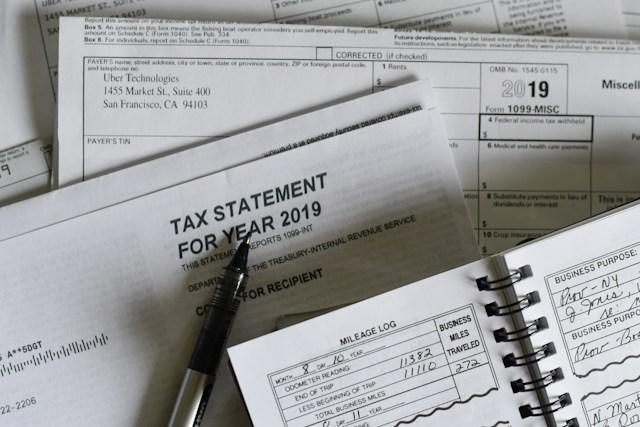

Businesses operating in the United States are granted a nine-digit identification number known as a Employer Identification Number (EIN) by the Internal Revenue Service (IRS). Consider it your company’s social security number, needed for a variety of financial transactions, tax returns, and adherence to federal laws.

An EIN’s Significance

Your EIN is more than just a piece of administrative paperwork—it’s the door to a world of financial possibilities and legal compliance. The EIN is essential for all aspects of running a business, including recruiting staff, applying for credit, opening a business bank account, and filing taxes.

Get Your EIN: A Comprehensive Guide

How to Get Around the IRS Maze

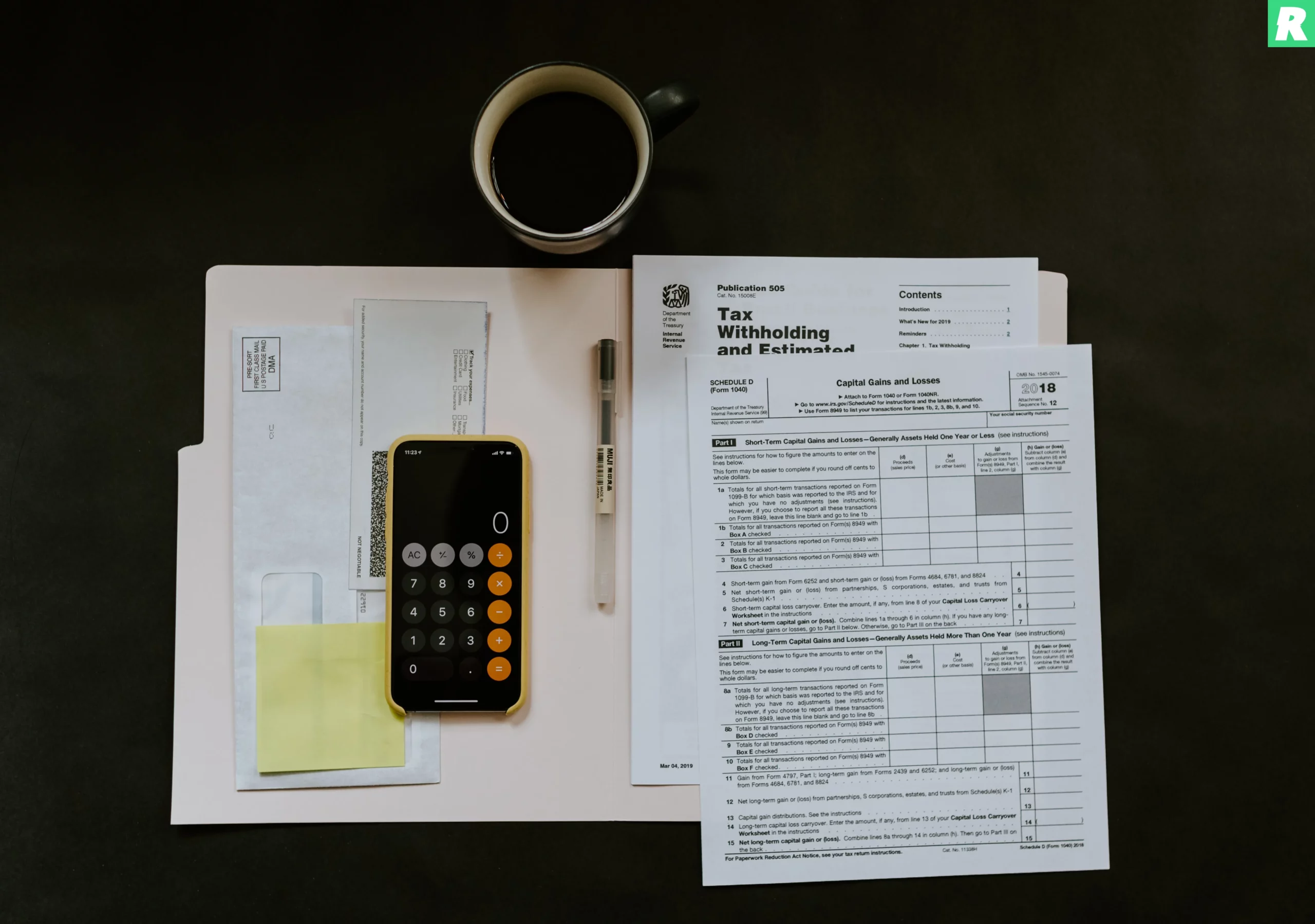

It doesn’t have to be difficult to obtain your EIN. To make the procedure go more smoothly, follow these steps:

To get an EIN, you can fill out an online application form provided by the IRS. Go to their official website and find the application portal for an EIN.Fill out the online application.

Send in and get your EIN right away.

Solving the Tax ID Mysteries: Frequently Asked Questions

Commonly Asked Questions

1. Is Every Business Required to Have an EIN?

Yes, for the most part. Getting an EIN is required if your company employs people, runs as a corporation or partnership, or satisfies other IRS requirements.

2. Can I Get My Lost EIN Back?

Indeed. For assistance if you have misplaced your EIN, get in touch with the IRS Business and Specialty Tax Line. They will help you navigate the healing process.

3. What Takes Place If My Business Structure Is Modified?

You can require a new EIN if your company experiences a structural change, such going from a sole proprietorship to an LLC. The IRS makes it very clear when making such changes calls for getting a new Tax ID.

Safeguarding Your EIN: Essential Guidelines for Entrepreneurs

Protecting Your Company’s Identity

Safeguarding your EIN is essential to preventing identity theft and fraudulent activity from harming your organization. It is a sensitive piece of information. Think about putting these recommended methods into practice:

Ensure Safe Storage: Put paper records holding your EIN in a safe place, and save electronic data on encrypted digital storage. Restricted Admission: Limit who can access your EIN to only the people who really need to know. Put in place a need-to-know policy to reduce the possibility of unapproved exposure. Frequent Inspections: Make routine audits of how you are using your EIN. Make sure it is only utilized for authorized business needs, and notify the IRS right once if you see any unusual activity.